Unlike many Chinese new energy car companies, Tesla suddenly announced a price cut this morning, and it was of unprecedented magnitude, instantly hitting the top of Chinese social media platforms!

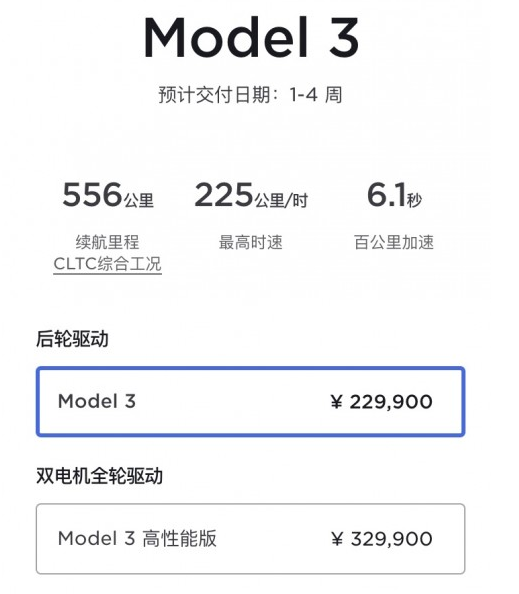

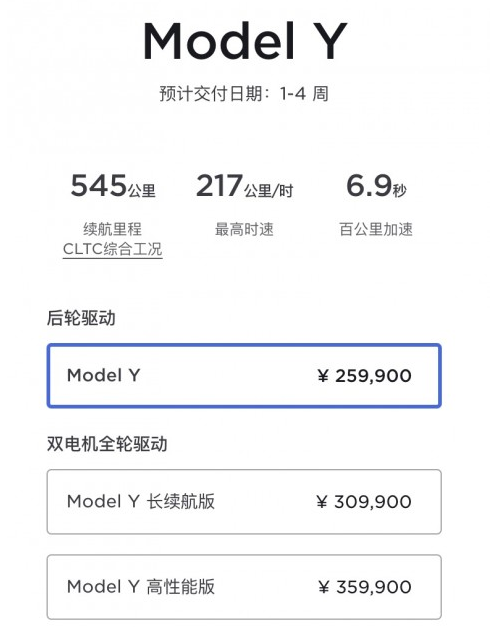

On January 6, from the official website of Tesla China, Tesla's two domestically produced cars were significantly reduced in price, with the starting price of both models hitting a record low, with the Model 3 dropping by RMB 2.0-36,000 and the Model Y dropping by RMB 29,000-48,000. Specifically, the Model 3 rear-wheel-drive version was reduced by RMB 36,000 and the high-performance version was reduced by RMB 20,000; the Model Y rear-wheel-drive version was reduced by RMB 29,000, the long-range version was reduced by RMB 48,000 and the high-performance version was reduced by RMB 38,000.

After entering 2023, including BYD, Chery New Energy, Changan Deep Blue and other car companies have announced price increases, mainly due to the impact of new energy subsidies and rising prices of raw materials, while Tesla, in contrast, chose to reduce the price of the operation is really surprising.

For the reason of Tesla's price reduction, Tesla's vice president of external affairs Tao Lin responded on Weibo: "Behind Tesla's price adjustment covers numerous engineering innovations, essentially the unique law of excellent cost control: including not limited to integrated vehicle design, production line design, supply chain management, and even millisecond optimization robotic arm synergy route ... from "first principles" and adherence to cost-based pricing."

It is understood that the benchmark price of battery-grade lithium carbonate has continued to decline in recent times, from a maximum of 607,000 yuan / ton down to 515,000 yuan / ton, and Tesla to self-operated sales, raw material prices directly affect the selling price of Tesla, price cuts are actually expected.

Cost decline is the main reason for Tesla's price increase, and the underlying reason is that Tesla's demand is declining. 2022 September, Tesla Shanghai super factory production line upgrade project was completed, the production capacity was once increased by 30% to about 22,000 units per week, resulting in a significant reduction in vehicle delivery cycle. According to the official website, the current pickup cycle for Model 3 and Model Y is 1-4 weeks, with the fastest pickup taking only 7 days, compared to the previous four to five months, indicating that Tesla's orders on hand have been slowly digested, and the significant increase in production capacity of the Shanghai plant far exceeds the growth rate of sales in the Chinese market.

Tesla oversupply, the most direct way is to reduce the price of subsidies to stimulate Chinese consumers to buy. Since the fourth quarter, Tesla has launched a massive marketing campaign, starting from September, Tesla has repeatedly launched model price cuts and promotions in the Chinese market, the largest of which was the price cut of two models of Tesla China on October 24, with a reduction of up to RMB 37,000, including a direct reduction of RMB 14,000-18,000 for Model 3 and RMB 2.0-2.0 million for Model Y. The Model 3 was reduced by RMB 14,000-18,000 and the Model Y was reduced by RMB 2.0-37,000. On November 8, Tesla China once again announced that from November 8 to November 30 (inclusive), Tesla will reduce the final payment by RMB 8,000 for the purchase of a current car and a combination of car insurance from a partner insurance agency, and will reduce the final payment by RMB 4,000 from December 1 to December 31 (inclusive). For example If you buy a Tesla in Shenzhen, China, for example, if you pick up the Tesla in December, the final cumulative subsidy can reach RMB 33,000 after combining various subsidies.

However, the effectiveness of Tesla's price reduction subsidy is not ideal. According to relevant data, Tesla China wholesale sales in November were 100,291 units, a new monthly delivery record, but in December there was a significant decline, wholesale sales fell 44.4% to 55,796 units. As a car company that delivers by order, the declining sales mean that Tesla's price-cut sales strategy may not be working and Chinese consumers are not buying. Of course, in the context of the rapid rise of Chinese new energy vehicle brands, Model 3 and Model Y already lack advantages in the Chinese market, which may be the main reason for Tesla's declining performance.

In addition to cost control and price for volume, the fight for a higher market position is also one of the main reasons. According to the official data released by Tesla, Tesla's annual sales of 1,131,900 units in 2022, although compared to a 40% increase, but Tesla deliveries have not reached the expected 1.5 million units. What's more, Tesla broke the new energy sales title in 2022, and although it is still the world's highest-selling pure car company, it has been overtaken by BYD in the new energy vehicle industry, which sold 1.857 million units in 2022. Perhaps even Musk did not anticipate that BYD, which he did not look at a decade ago, has become one of Tesla's strongest rivals in the global market.

As for whether Tesla will reduce the price, the probability is still will. From the point of view of manufacturing costs, Tesla Shanghai Super Factory has achieved more than 90% of the supply chain localization in 2021, the current parts localization rate has increased to 95%, the decline in production costs makes Tesla products have further room for price reduction. At the same time, Tesla's gross profit margin is much higher than that of major global automakers, which does not preclude Tesla from breaking the pricing logic of international brands and exploring the price range with cost orientation to gain a higher market share.

Back to the price cut itself, Tesla suddenly announced a price cut or a bit unprepared. Switch to the user's perspective, especially the recent car owners, the mood is difficult to say, and even a number of owners began to form a "rights group" solitaire respective loss amount, to defend their rights against price cuts.

Tesla price cuts against the trend, can be analyzed from two major aspects, one is that Tesla has a more flexible supply system, and the second is the high gross margin allows Tesla to seize the market through price cuts. Of course, product price increases and decreases belong to the normal business behavior, but frequent price adjustments for users is not friendly, easy to trigger user dissatisfaction, reduce user loyalty, these often turn into rights events. Therefore, the trade-off between pricing freedom and consumer rights is also worthy of deep consideration by car companies.